Now, this is one almighty supplement. One of the new age of supplements I’d say. These combine your typical supplement with herbal ingredients..and…it makes for one mega supplement. I’d think it is quite a pricey one, especially when you look outside of the USA. But, if you manage to snap it up in a Black Magic Brain Waves sale, then it’ll be more worth the money.

Read MoreTre Venezie Lavazza Compatible Coffee Pods

A slightly different review here, but nonetheless still totally relevant as it is something I regularly use prior to a gym session, a simple coffee. Albeit a strong one, but a coffee. Why? Caffeine, this is one of the main ingredients when it comes to stimulant pre-workout supplements. Therefore, having a coffee still makes a significant difference to your performance in the gym. For today’s review, I am sampling these Lavazza coffee pods compatible with the A Modo Mio Lavazza coffee machines.

Read MoreReview: PhD Nutrition Pharma Whey

My review of PhD Nutrition’s Pharma Whey. I will go into a deep review of each and every single ingredient and give my honest opinions (in no way I am affiliated with PhD Nutrition – therefore no bias). Starting off will be an overview of the product and a general insight as to why you may, or may not, need this supplement. Next will be the packaging, appearance, smell, taste, price, then concluding remarks.

First off, the overview of PhD Nutrition Pharma Whey HT

What is PhD Pharma Whey HT? Note that from now on I will refer to the product as phd pharma whey for short. There are many variation, but I suppose this is the full full version: PhD Nutrition Pharma Whey HT+, but for short phd pharma whey. Now, with that out the way, phd pharma whey is a whey protein supplement designed to help those increase the protein content in their diet in a convenient way.

Read MoreReview: Quest Nutrition Protein Bars

There really was so much hype when these bars were brought to market in the US and subsequently the UK. With all the social media promotion and talk the bars were an instant hit when they reached the shelves of UK supplement shops and websites. Over the past couple of years or so, Quest Nutrition have come out with a staggering number of flavours of protein bars to add to the ever growing collection. I’ve been awaiting a supplement retailer here in the UK to supply me with such bars and I wasn’t disappointed. Speaking with a supplement retailer, I eagerly awaited them. Quest bars cheap are what Supplements2u offer, with some crazy deals on multiple boxes and short dated ones.

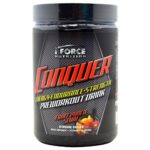

Read MoreReview: iForce Nutrition Conquer Pre-Workout

Iforce’s answer to the pre-workout supplement. Their name, Conquer. A point on the name, quite a good choice when you think about it, Conquer, as in conquering the gym, achieving that next rep or next weight, a very apt name. About the actual supplement that we got our hands on, that was very kindly supplied to us by the guys at Supplements2u who sell iForce preworkout at possibly the best price I think we have ever seen here in the United Kingdom. The pre-workout supplement and nature best vitamins pack a whole load of punch and we are a fan of this creation from Iforce Nutrition.

Read MoreReview: MuscleFood Mighty Meat High Protein Pizza

An excellent quality tasty pizza with the added bonus of being packed full of protein! MuscleFood really have hit the spot for a protein rich pizza that can be classed as a ‘cheat meal’. Price wise, if buying individually £4.95 is quite steep when it comes to the cost, but buying in packs of three from their website brings it down to £14 for three which is slightly better. Then again it depends on what you compare this too as a take-away pizza will be similarly priced if not more but will not have the same epic macros like this one!

Read MoreReview: USN Pure Protein GF-1

Pure Protein from USN is one of their best selling products and has been for many years. The reason being that it is such as fantastic blend of protein that also taste great and is generally well priced. USN Pure Protein GF-1, commonly referred to as USN Pure Protein or USN IGF has had a couple of name changes over the past few years. This has been carried out so that the company complies with labelling laws for supplements.

Read More